Is Responsibility Insurance Coverage Required in California? Yes. Obligation insurance coverage covers accidents where Click for more you are at fault. Home damages obligation spends for any kind of damage you trigger, as well as bodily injury obligation covers injuries you create to others. Does The Golden State Accept Digital Insurance Coverage Cards? Yes, you can utilize your smart device to provide proof of insurance policy.

The rates revealed below are for comparative functions only and also must not be considered "typical" rates available by individual insurance companies. Because vehicle insurance rates are based upon individual factors, your vehicle insurance prices will certainly differ from the prices revealed right here. car. U.S. News 360 Reviews takes an unbiased method to our referrals.

car insured insurance cheaper dui

car insured insurance cheaper dui

The ordinary car insurance coverage cost in The golden state can range from $733 for very little coverage to $2,065 for full coverage (car insured). Getting an exact response is hard without responding to a whole lot of concerns like where you live, and your automobile model, amongst others (insurance company). In spite of every one of that, knowing the average cost is at the very least an excellent beginning factor in identifying what you might have to spend.

So, keeping that in mind, we'll examine the typical expense of car insurance coverage in The golden state. Then we'll dig deeper to discover exactly how you can maximize your cost savings while getting the coverage you need. The Variables that Influence Ordinary Cars And Truck Insurance Coverage Prices in The golden state It's possibly not a surprise to discover that not everyone pays the exact same rates for automobile insurance coverage in The golden state.

The Buzz on What Is The Average Cost Of Car Insurance In 2022?

As for the insurance providers are worried, the ideal are motorists that are predicted to have the fewest claims. That implies they drive securely and sensibly. On the other hand, higher-risk clients are those that could be most likely to turn in even more claims and also create the insurance company more cash. The insurance companies look at teams of individuals to figure danger based on exactly how others in the exact same group normally behave. insure.

Consequently, young guys will usually be billed a lot more for their car insurance coverage than those who are older or woman. There are 7 elements that have a tendency to establish automobile insurance coverage rates that customers will spend for their protection:. Age, gender, as well as marriage condition are considered here. As mentioned, young males tend to be at a greater threat.

And also wedded people are often safer chauffeurs than solitary individuals. Fees mirror every one of that. Some vehicles are developed and developed with more security attributes than others. Some are very pricey to repair, so insurance companies bill extra for coverage. That's why it makes good sense to ask your agent concerning premium prices for a specific version before you buy it.

Exactly how do you utilize your car? If you commute daily for fars away, you can possibly expect to pay even more for your plan than if you only placed a few thousand miles a year on the odometer. It might not appear fair, yet you're likely to pay more for your insurance coverage if you have a poor credit rating.

5 Easy Facts About American Modern Insurance Group: Home Shown

You can also pick to take just minimal insurance coverage as mandated by your state. That would be responsibility coverage, which we'll explain later on. Average Yearly Car Insurance Policy Expense in The golden state As you can see, there are a great deal of aspects that will affect the expense of auto insurance in The golden state for you.

Right here's the average yearly auto insurance rates in The golden state in 2021 for general guidance. Complete insurance coverage: $2,065 Very little insurance coverage: $733 What Minimal and also Complete Insurance Coverage Insurance Method The ideal description of those terms is that complete insurance coverage uses the most effective economic security. Minimum protection gives the least expensive degree of automobile insurance coverage that each state will certainly permit a chauffeur to have.

This is called obligation insurance coverage. If you was accountable for a crash that wounded an additional vehicle driver and harmed an automobile, your insurance coverage would certainly compensate to a specific dollar quantity for the injury and damages to the various other car. Yet you would certainly not have the ability to transform in a claim for the damages to your own automobile.

Driving a lorry indicates having car insurance policy, since in California it's a demand (car). California does not play games when it involves driving as well as staying guaranteed. There are loads of car insurance coverage carriers offering great deals of various choices that fulfill or surpass the state demands since there are millions of chauffeurs to insure.

The Buzz on Blue Shield Of California - California Health Insurance

cheap auto insurance accident low-cost auto insurance insure

cheap auto insurance accident low-cost auto insurance insure

Typical Price for Minimum Vehicle Insurance Coverage Needs in California, The golden state, like nearly all other states, has produced state regulations that mandate lorry owners need to have a particular level of car insurance coverage (cheapest car). If you're driving in The golden state, you are lawfully called for to have insurance and also the plan details should remain in the lorry with you - money.

auto laws vehicle insurance insurers

auto laws vehicle insurance insurers

Worth, Penguin has the highest yearly standard of $617 for minimal coverage. Given that information, it's safe to state car insurance policy will certainly cost around $550 a year or even more if you opt for extra coverage.

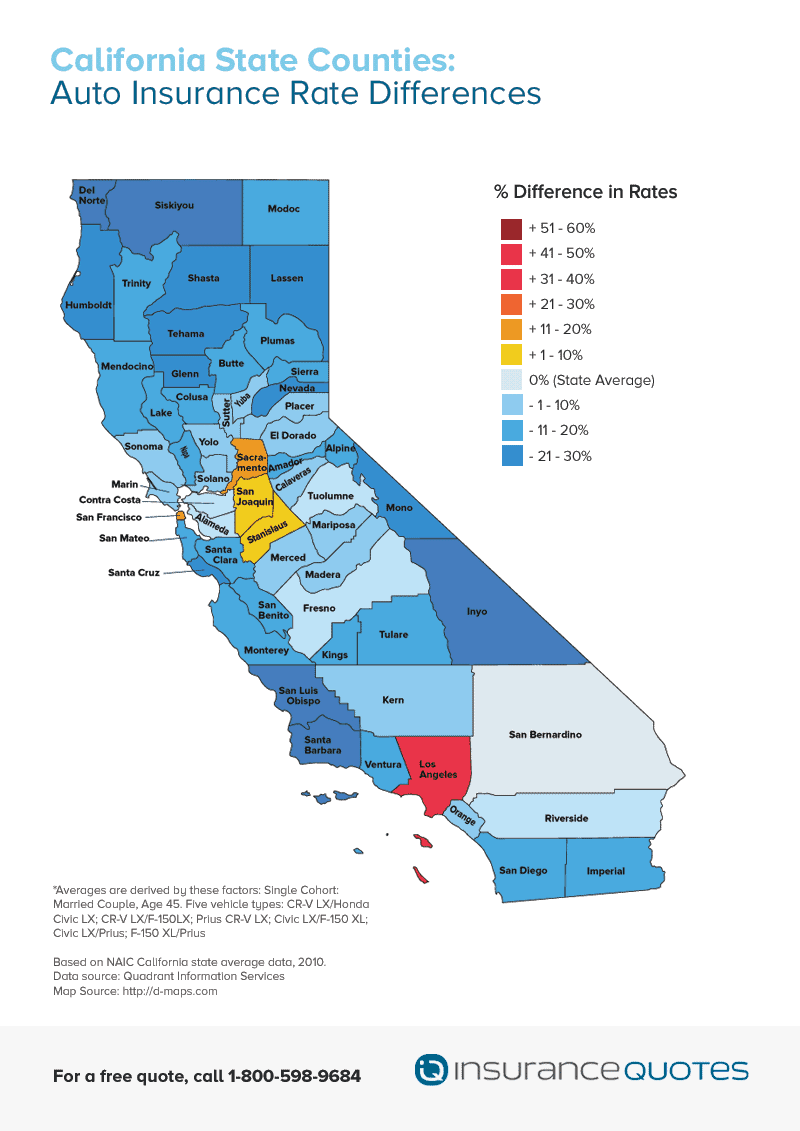

Average The Golden State Automobile Insurance Policy Prices Past the Minimum, If you stay in The golden state you won't be too surprised to discover that the yearly cost of vehicle insurance is 20% higher typically contrasted to other states. cheapest. But that's thinking about all 27 million The golden state chauffeurs, a number of which pick to get auto insurance protection beyond the minimum necessary amounts.

55. The Zebra approximates the typical annual premium for California automobile insurance coverage is $1,713 a year. There's a large spread in between the averages forever factor. A great deal of variables enter into the cost of a vehicle insurance policy premium (risks). Suppliers are considering your age, marital relationship standing, place as well as driving document before they give you a quote - cheaper auto insurance.